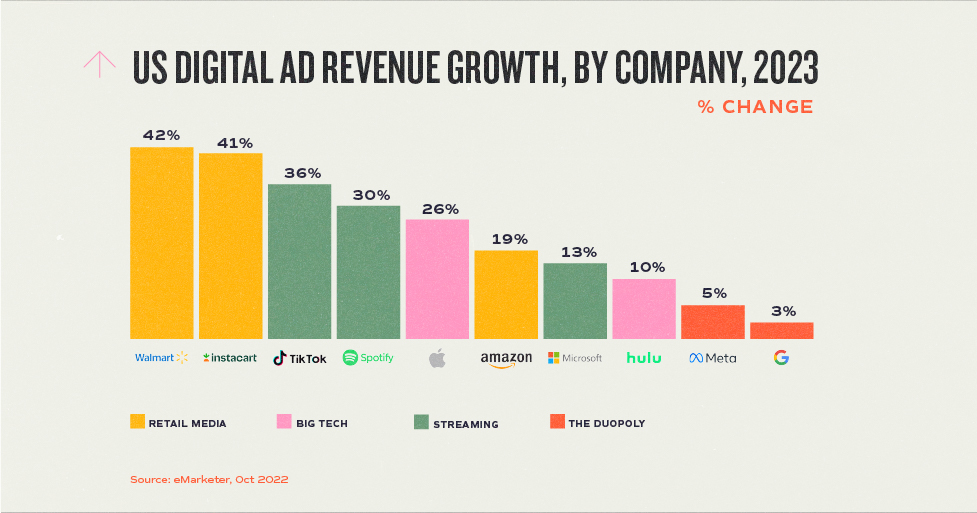

It took a global pandemic to expedite it, but Retail Media is having its time in the spotlight. Retailers have been sitting on first-party customer data for years, and now that data is driving this channel to the top of the growth charts as reported by eMarketer. Move over Meta and Google, there’s a shiny new object in marketers’ pockets called Retail Media (RM) and, according to AdWeek, it’s expected to exceed $50 billion in the US this year.

Note: includes advertising that appears on desktop and laptop computers as well as mobile phones, tablets, and other internet-connected devices, and includes all the various formats of advertising on those platforms; net ad revenues after companies pay traffic acquisition costs (TAC) to partners’ sites; Google includes YouTube advertising revenues; Meta includes Facebook and Instagram advertising revenues; excludes revenues reported under Meta’s “Facebook Reality Labs” segment; Microsoft data from 2016 forward includes LinkedIn ad revenues.

At MBB, we upped our presence in RM at the start of the pandemic as many other brands in the CPG space did. Consumers still had needs, which resulted in increased adoption of online shopping. Shoppers were hesitant to step foot in brick-and-mortar locations, and our clients had functional products to sell, so we jumped on the early bandwagon. We ripped up our approved 2020 strategic plans in early March and started over with a revised objective in mind as we followed consumer behavior.

We talk a lot about ROI and ROO at the agency. Ideally, we always want to report back on ROI, but sometimes we need to think about the impact and return on our objective. In 2020, one of our clients, the Chinet® brand, was slated to relaunch the brand with new packaging, messaging and a desire to introduce the Chinet® brand to new audiences. We planned to leverage upper funnel tactics to accomplish this and measure ROO for our efforts. That shifted pretty quickly in the spring when we detoured and put greater emphasis on e-commerce efforts at retail. Across both retailer-specific media (think Kroger and Roundel) and retailer-agnostic platforms, like Instacart, we set out to drive sales, move products and measure ROAS for our efforts. Three years later, shoppers have adapted to use both online and offline channels, and retail media has taken a seat in mainstream marketing. The results we’ve seen (often 4x ROAS benchmarks) have supported our continued investment in this space as a critical component of our media plans.

Articles dub Retail Media as digital advertising’s third big wave after search and social – and it’s destined to eventually be the biggest. There’s no doubt that this channel will continue to position itself as a necessary tactic in client marketing plans. Pressure from consumer behavior is coupled with pressure from retail buyers though, who dangle shelf space and positioning as a trade for media spend. They recognize the demand and value that their retail media networks bring to brands, and we see it as a targeted opportunity to reach receptive audiences with POS at the digital shelf. It’s a mutually beneficial relationship, one we expect to continue to manage on behalf of our clients going forward.

Subscribe to our newsletter

Get our insights and perspectives delivered to your inbox.