COVID-19 has had a profound impact on our lives over the last two months, completely altering everything from the way we eat, to where we work, to whom we interact with. So it is no surprise that our attempt to avoid this microscopic yet life-changing virus has also transformed our shopping habits. Major brands and retailers have had to make significant changes to navigate the short-term challenges that the coronavirus has created around safety, supply chain and staffing. In fact, according to Ernst & Young, 42% of surveyed consumers believe their shopping habits will be fundamentally altered because of the coronavirus pandemic.

However, the question on everyone’s mind is, how long will those changes in shopping habits last? More importantly, will these changes impact our behavior forever? Here are five changes we’re seeing in the CPG industry and our prediction on if they will stick around.

Panic buying: Will it continue and for how long?

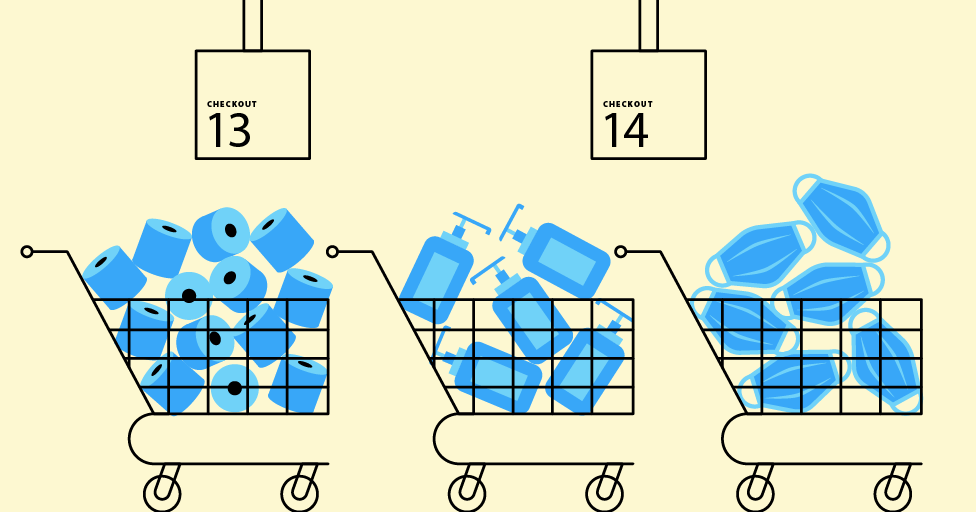

One of the first—and most jarring—consumer purchase changes was panic buying. As consumers, we lived this extraordinary change to the way we purchase and the rollercoaster of emotions that came with it. First, there was denial followed by judgment of individuals who were hoarding toilet paper and bottled water (why bottled water, I’m still not sure). Then came your own fear of realizing that if you didn’t stock up you could be left begging your neighbor for some TP or making the much-dreaded trip to the biggest box retailer you can find. Lastly, there was the relief in knowing you had enough product to last you through the near future but questioning your long-term strategy.

Panic buying led to an increase in year over year spend per shopping trip, and the number of products purchased increased across the industry in March (RESONATE). In fact, Costco saw a year over year sales increase of 12.4% in February and 9.6% in March (for stores open at least one year) (CNN). Items that were most commonly panic purchased included facemasks, hand sanitizer, thermometers, oat milk (it’s shelf stable!), pet food, shelf-stable snacks, water and toilet paper (Business insider). Paper goods, cleaning supplies and other household goods also saw a significant spike.

So what happens next? Items with slow burn-through rates—like cold medicine—will most likely see a decline in sales in the future as people gradually use the products. However, others like Clorox wipes and hand sanitizer will continue to be in high demand –and therefore subject to hoarding—for months, if not years. Clorox is projecting to be in low supply through the summer (USA Today). Just in time for a potential second wave.

As long as there is still a fear of the virus, there will still be hoarding—however, the products in demand will change slightly. For example, protein can now be hard to find as many meat manufacturers have begun to pause production. As a marketer, clearly communicate to your consumers what products are in stock and, if a product is out of stock, when it will be back. Consider adding an email notification when a product is back in stock or a discount to purchase it before it comes back in. This will maintain brand loyalty and reduce frustration on behalf of the consumer.

Digital commerce: Is this the end of brick and mortar?

Many consumers are asking if we will ever need to go inside a grocery or retail store again. Why stroll the aisles of your favorite big box retailer—or even small boutique—and risk getting infected when you can do the same from the safety and comfort of your own house? Many of us were already accustomed to making (almost daily) purchases online. Categories like books and electronics had already pivoted to primarily e-commerce but that wasn’t necessarily true for apparel and grocers (Forbes). COVID-19 instantly changed that.

Foot traffic to stores across all industries dropped dramatically, even before stay-at-home orders were in place (Google Data Studio). Two months later and traffic is still down at most major retailers. While restrictions are being lifted, we now know that consumers will do what they feel most comfortable with—not what they are told to do by the government. This leads many to believe that foot traffic will stay low, potentially putting an end to brick and mortar as we know it today.

Take grocery stores, for example. In 2019, only 4% of grocery store sales were online. (Forbes) However, in the midst of the COVID-19 pandemic, online orders at grocery stores are so prolific, even major retailers cannot keep up with demand. Delivery dates are getting pushed back—if consumers are even able to place an order—and many items need to be replaced with substitutes. And the transition from in-person grocery shopping to online changes what people purchase. Impulse buys and new trial are not nearly as common. Marketers must find a way for their product to stand out from competitors in crowded online aisles.

Online grocery ordering is not only a change in consumer shopping habits, it is causing additional trends to develop such as a dependence on delivery as well as a decline in product loyalty and willingness to pay a premium.

Dependence on delivery: Is this the future?

If you can’t go out, you might as well bring it in, right? It is absolutely no surprise that Instacart, Shipt, Amazon, and Walmart Grocery Delivery have all seen surges in sales and downloads of their apps. Food delivery apps like DoorDash, Uber Eats and Grubhub are also seeing a spike in usage.

But these services don’t come without a cost. Once taxes, service fees and tips are added onto an order, the price of delivery can make the final cost skyrocket. This isn’t stopping shoppers from paying a premium to have home delivery of their groceries, among other purchases. It begs the question—what is the price of safety?

While consumers are spending more time on home delivery, pickup and online shopping apps, not all retailers have given into the trend. Companies like Trader Joe’s still don’t offer delivery and have no future plans to. Yet, the stores have lines wrapped around the building. Is this sustainable? The company believes that they have taken the necessary safety precautions and that their customer service and unique product offerings will keep consumers coming in the door.

Will consumers get used to the convenience of delivery or go back to their old, antiquated ways of shopping? It will likely depend on the retailer and the category. As a marketer, do what you need to do to get your product into your consumers’ hands. Don’t make it too difficult on them or you’ll risk losing a loyal customer base.

Willingness to pay premiums: What is the cost of safety?

We’ve all likely overspent throughout the past few weeks. Sometimes out of necessity, other times out of pure boredom. Regardless of the reason, COVID-19 has led us to not bat an eye when paying a premium. As we discussed before, there will always be a premium for delivery. In fact, people are paying more than the typical 10-20% tip, as a way to say thank you to the delivery person who is out risking their own safety. We are also paying a premium for products that we wouldn’t typically splurge on like streaming more movies, buying more toys for the kids, eating out more often as a way to entertain and reward ourselves. Not buying a pool pass this summer? An extra-large inflatable pool (with slide AND a bounce house attached), why the heck not!? Lastly, and most commonly, consumers are paying a premium due to scarcity. We’re willing to trade up on a more expensive brand if it means getting it in our shopping cart.

As a marketer, don’t price gauge. It’s unethical and potentially illegal. Do evaluate your consumers changing price point—as it goes both higher and lower. Also, consider marketing your higher end products to certain audiences who may have more discretionary income now that their vacation to Mexico has been cancelled.

Decline in brand loyalty: An opportunity to stray

Private label or off-brand product purchases have been gaining market share for several years, and COVID-19 has only accelerated that growth. While many consumers are brand loyal or at least habitual in their shopping purchases, the scarcity of products and increase in online purchasing that came with the pandemic has changed all of that. When a consumer’s favorite brand of (enter absolutely anything in here) isn’t in stock, consumers will naturally look at similar products, often with a different brand name. This is even easier now with online shopping that allows individuals to easily compare product features and price. Giving consumers the opportunity to stray from their once deep loyalty is risky. It opens their eyes to a world beyond Huggies diapers or Sabra hummus.

As marketers, it is important to continue to remind your customers of your unique product offerings (hint: don’t cut your ad budget) and reward brand loyalty.

This is not a time for brands to go quiet, it’s a time for brands to evaluate where their consumers are (consuming media), evaluate what they are doing (shopping habits), and understand how they feel (messaging). Most major brands have thrown their media plans out the window and are reforecasting what makes the most sense right now. Brands are still advertising but shifting their messaging to how they can support consumers and bring people together digitally during COVID-19. Those messages will continue as consumers figure out their new normal when states open up

Sources:

RESONATE

CNN

Business Insider

USA Today

Forbes

Google Data Studio

Subscribe to our newsletter

Get our insights and perspectives delivered to your inbox.